Imagining a world without technology may be an almost impossible task in the 21st century. As ubiquitous as technology is in our daily lives, it seems only natural to make it a part of our everyday finances as well. One way to do this is by investing in tech stocks, effectively buying into your chosen companies.

Although it seems to be a pretty straightforward process, speculating in the tech sector can be as arduous as it gets; especially if you don’t know the fundamentals of finance. That’s a good enough reason to educate yourself in the right way. Here are a couple of tips that should sort you out if you’re a stock investment virgin.

Be Sure To Check The Fundamentals

Examining the technical details of a stock can only help you to a certain degree; in order to achieve a broader view, you also need to analyze the fundamentals of the company.

Which brings us to the question—what are the fundamentals of a company?

The analysis of economy in general, the industry/ sector to which the company belongs, and in-depth company analysis itself are the three main activities when performing fundamental analysis of a stock. This three tier approach takes care of the internal factors as well as the external factors that can affect a company’s stock price.

It’s best that you start by examining the large volume of information available on a company’s income statement, balance sheet, and annual reports. An income statement indicates the revenues and profits generated by a company. The balance sheet and the cash flow statement, on the other hand, present a treasure trove of data which tells you all you need to know about a company’s current financial state. For example, by understanding the financials only one understands why companies like Apple, Akamai are great investments!

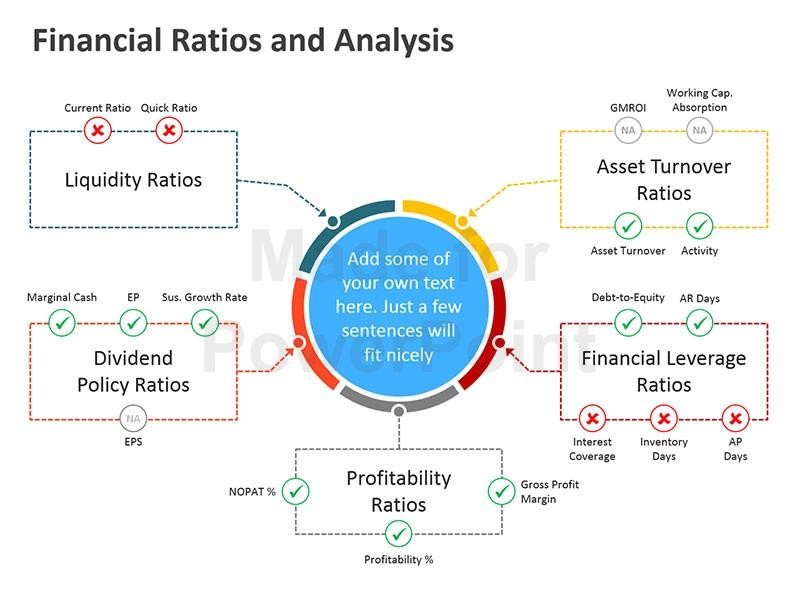

Understanding Financial Ratios

Source: Heyaccounts.com

Sometimes, a massive volume of financial data may be too bewildering to handle. Financial ratios are useful tools that can help you get a better grip on the information available. When you analyze a company using certain financial ratios, you can learn much more about its present condition as opposed to simply studying large sets of financial figures. Financial ratios are used to analyze a firm’s standing in terms of its liquidity, profitability, debt, cash flow, etc.

Before deciding to invest in any tech stock, make sure that you develop a thorough understanding of frequently used financial ratios such as the P/E ratio, PEG ratio, P/B ratio, current ratio, debt-to-equity ratio, and dividend payout ratio. For example, Amazon has always enjoyed a high PE and has always been considered a growth stock. However, a closer look reveals that Amazon fundamentals have deteriorated through recent times. Find yourself hidden gems to invest in by prudently using a combination of financial indicators, and don’t go my just a single metric as it does not give the complete picture.

Diversify And Minimize Risks

Like they say, never put all your eggs in one basket. The tech sector is undoubtedly a great place to be making investments; but is it really the only the option around? You should also consider the fact that there are other, better-performing sectors out there. For instance, in 2014, the best-performing sectors were utilities (up 26.88%) and healthcare (up 24.9%), with IT a distant third (up 19.16%).

You will inevitably limit your options if you stick to merely the tech sector. A better strategy would be to choose only those stocks in the top-performing sectors that are most-likely to fetch you returns. Going for the 10 best stocks in 3 different sectors as opposed to 30 stocks in one sector minimizes your investment risk, and lets you reap the benefits of diversification.

You can also invest in exchange-traded funds (ETFs) if you think individual stock selection is a bad idea. There are multiple advantages to investing in ETFs,

- ETFs offer a diversified portfolio, similar to index funds

- You can sell short or buy on margin

- Buy or sell multiple stocks as a single share

Some of the most popular tech ETFs available on the market include the Technology Select Sector SPDR (XLR), Information Tech ETF (VGT), iShares U.S. Technology ETF, (IYW), and DJ internet Index Fund (FDN).

Don’t Forget The Basics

Sometimes, the simplest rules turn out be the most forgotten ones. This definitely holds true with the one golden rule of investing—buy low and sell high. In the heat of the moment, often misguided by their emotions, investors buy shares at artificially inflated prices and end up selling at a loss. Being a good investor is all about being one step ahead of the herd. Don’t always look to buy what the majority of the market is after; rather, go for those oft-ignored stocks with the best future prospects.

Knowing when to sell is just as important as being of aware of when and what to buy. Remember that even the best stocks have a hard time maintaining their positions when an entire sector goes downhill. More importantly, learn to be dispassionate towards your investments. Successfully investing in the stock market takes oodles of patience, so you better prepare yourself before getting on a financial roller coaster.