Written by Songshun Steel

Trump seemed to have made a big change in the steel industry last year when he imposed 25% tariffs on imported steel. His decision caused fright among buyers in the United States who had to make sure that their supply wouldn’t be interrupted while the situation indicated the opposite. This made them rush to place new orders, causing prices to skyrocket.

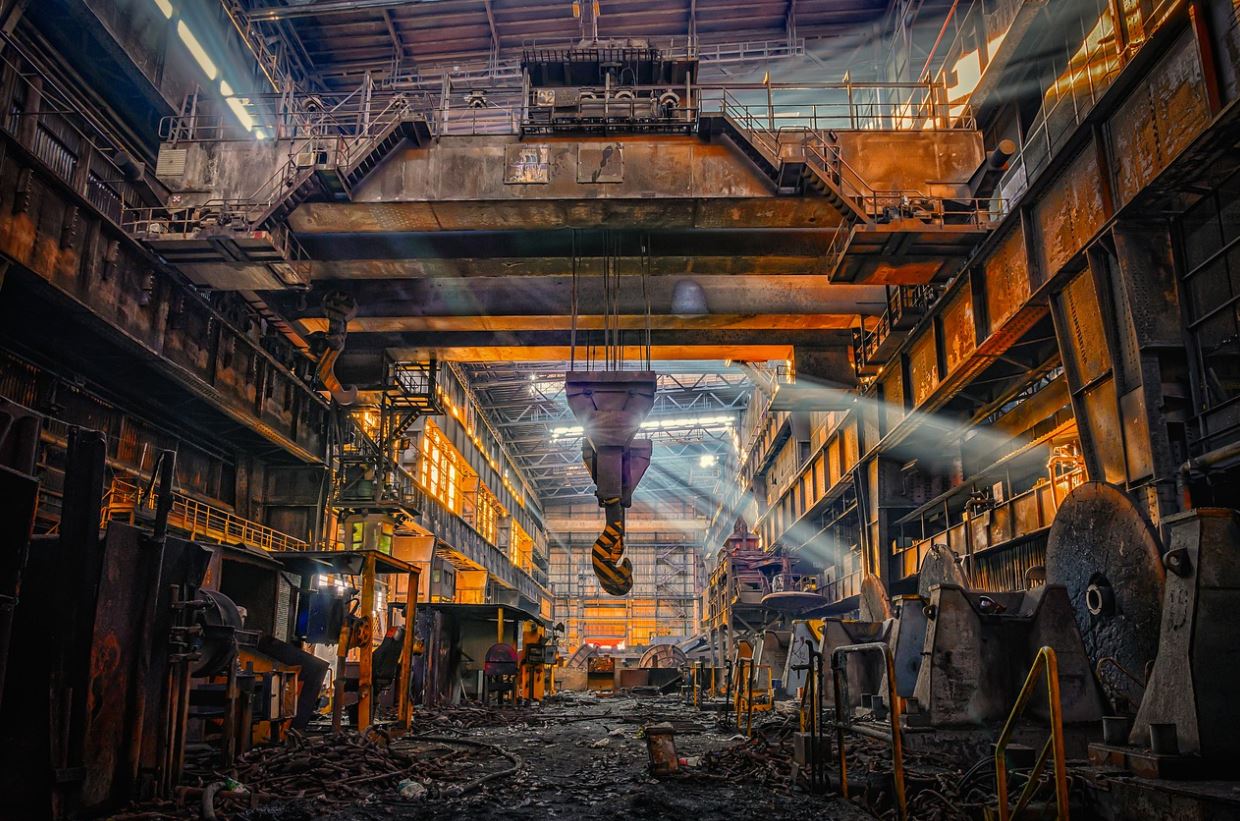

For a while, it became a kind of blessing for domestic steel suppliers. This excitement even gave some makers the courage to plan expansion. Meanwhile, United States Steel Corporation saw it as a great opportunity to breathe new life into its two long-idled furnaces in Granite City. Trump delivered his fiery speech at the factory about what appeared to be the industry’s revival.

A year has passed since then, and sadly, a good year seemed to have passed too, since steel prices have plunged to the point where they are lower than they were before the 25% tariff imposition. Thus production cutbacks become inevitable in the industry.

U.S. Steel still operates its Granite City blast furnace. However, it has started to lay off many employees at two other old smelters, in East Chicago and near Detroit. Some other steel manufacturers are either shutting down plants, idling workers, or reducing work time; leaving general employment in the steel industry a bit different than it was a couple of years ago.

Metalworking firms across the United States also struggle to secure not only tool and die steel on a timely manner at worldwide prices, but also other metals from alloy 4140 steel to high speed steel including M2 steel.

Potentially, this could become a political issue for Trump as well, who was elected partially for his promise that he would help revive the U.S. industrial sector and its blue-collar workers. Ironically, this whole steel problem was largely caused by Trump’s own policies which prodded manufacturing bosses to build their firms and workers for themselves.

Trump’s import tariffs, tax reductions and pro-business speech gave steel manufacturers a lot of confidence, or probably too much. With all of the spare money in their coffers, these companies were spending excessively on their expansion even in places where steel wasn’t really needed. Not only they increased production capacity beyond the requirement, but also invested in new plants.

Trump’s liking for on-again, off-again trade war rhythm also contributed to the global economy slowdown. Now U.S. manufacturing is falling into a deep recession due to this warfare. Unsurprisingly, higher capacity and slow demand has created a painful combination for the steel industry.

According to analysts, it’s estimated that over 50 expansions and restarts that have been announced will raise domestic steel production volume by around 20% in the next two to three years.

Indeed, the tariffs have managed to restrict imports and increase the domestic share of steel production in the United States. Steel import share have declined from around 30% to 20%, something which Trump administration officials and AISI (American Iron and Steel Institute) see as a good thing.

However, even if imports go down to 0%, production volume would still be higher than needed in the U.S., meaning that the painful combination still exists. What’s more, it’s expected that demand for steel will fall even further in 2020 while production capacity starting to increase.

One of the reasons for the slowing demand is the decreased use of steel as a material for cars. Automakers today prefer to use more aluminum than steel for most of their vehicles. This will likely cause steel prices to go even lower than they are now, which are already lower than before.

Trump’s tariffs clearly don’t give the desired results. When he placed the duties, the intent was to put a ceiling on imports which were considered a threat to U.S. national security, but not many supported his thinking. Now this move has upset major steel exporters, including allies like the European Union and Canada, which is the top exporter and importer of alloy steel powders to and from the U.S.. Those countries struck back by imposing tariffs on American imports.

Recently, the U.S. has reached a deal with Canada and Mexico to lift steel duties as the two countries approved a new North American Free Trade Agreement. However, that didn’t undo the damage that has arisen due to this trade war.

So basically, Trump’s tariffs didn’t solve the root of the problem, namely the global oversupply driven by China’s overproduction, which amounts to 50% of the world’s supply. Previously, Washington had imposed a lot of duties on China for dumping excess steel onto the world markets and unlawfully financing Chinese manufacturers. Even before the latest tariffs, China’s share of steel exports to the United States was only 2%. So it’s very unlikely that any more steel-related sanctions will hurt the country.

Trump’s tariffs also didn’t improve the efficiency in the American manufacturing. They only postpone a shuttering of traditional, more costly integrated mills which are no match for mini mills with their Electric Arc Furnace (EAF) technology.

A good example in this case is AK Steel’s Ashland plant. The West Chester-based steelmaker first took the plant offline in late 2015, but it took until September this year before the company announced that it would really close the Ashland facility by the end of 2019. This time it would be a permanent closure as there’s no point of return. Due to the move, 260 jobs are going to be eliminated.

According to AK, Trump’s tariffs actually did some good, but they were not enough keep the Ashland plant alive amid unprecedented levels of worldwide steel capacity and fraudulent trade practices.

As steel prices going down and the industry is in the shift to cheaper non-union mini mills, more conventional mills could eventually face closure as well. Project labor contracts, long-term purchase agreements, and steelmakers’ insistence to extend the life of their old plants will inhibit restructuring. On top of that, firms won’t likely cancel their plans for new manufacturing facilities and expansions.

Obviously, we can conclude that the tariffs on steel imports hurt more than help the level of competitiveness of American steel in the long-term. Despite the fact, unfortunately, we can’t reverse the negative impact that is already happening in the industry.

The tariffs have backfired, but more than that, they have made angry many steel consumers and small steel suppliers(who point the finger at the Trump administration for playing favorites.