August 10, 2022

Click for PDF

Gibson Dunn has surveyed the comment letters submitted by public and private energy companies and related industry associations regarding the proposed rules by the Securities and Exchange Commission (the “SEC” or “Commission”) on climate change disclosure requirements for U.S. public companies and foreign private issuers (the “Proposed Rules”).[1]

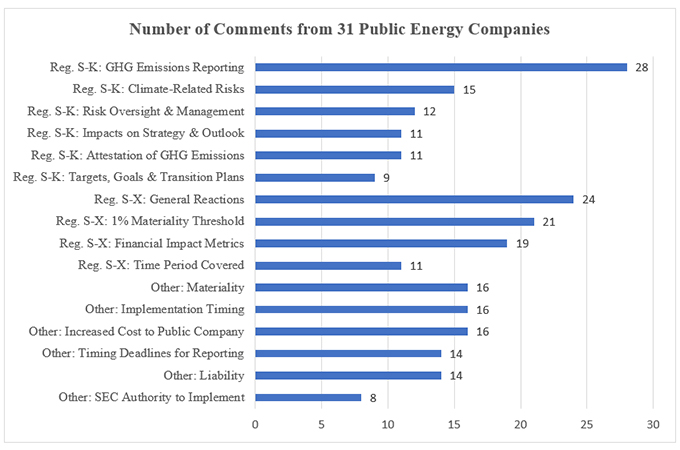

Based on our review of these comment letters, we have seen general support for transparent and consistent climate-related disclosures, along with a concern that the Proposed Rules do not reconcile with the SEC’s stated objective “to advance the Commission’s mission to protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation, not to address climate-related issues more generally.”[2] Overarching themes included (i) general support for the Commission’s decision to base the Proposed Rules on the Task Force on Climate-Related Financial Disclosures (“TCFD”) framework and Greenhouse Gas Protocol (“GHG Protocol”), (ii) concern with deviation from the long-standing materiality threshold, (iii) concern that the Proposed Rules would overload investors with immaterial, uncomparable, or unreliable data, and (iv) questions as to whether the Proposed Rules would cause an unintended chilling effect on companies to set internal emissions reduction targets or other climate-related goals to avoid additional liability risks in disclosing such goals. The proposed disclosure requirements receiving the most comments from energy industry companies relate to (i) the Greenhouse Gas (“GHG”) emissions reporting (particularly Scope 3 emissions …

Energy Industry Reacts to SEC Proposed Rules on Climate Change – Gibson Dunn